Water

SUEZ and PYREG launch an innovative integrated pyrocarbonisation solution to produce biochar from sewage sludge

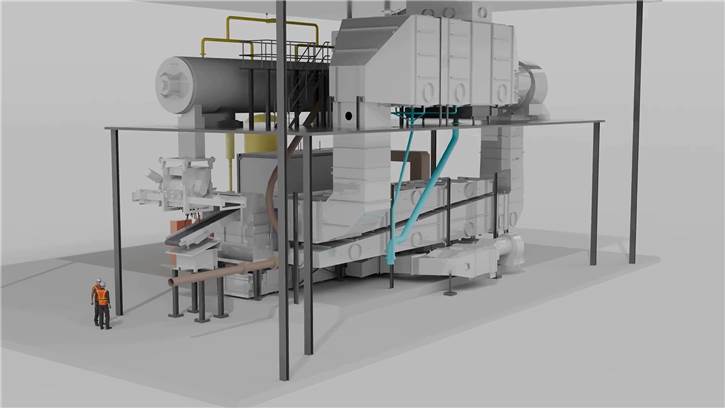

SUEZ and PYREG, a global leader in organic waste pyrolysis solutions, are pleased to announce the...

.jpg?h=408&w=725&v=1&d=20260129T161323Z&format=jpg&crop=1&hash=9E5DFEDA3B5B9D10DF27B73DA7F831CC)