1st half 2025 results

Former financial results

17 April 2025 - Investors presentation

17 April 2025 - Communication - "SUEZ 2024 Annual Results: significant growth in EBITDA and Free Cash Flow, major commercial conquests"

17 April 2025 - Consolidated financial statements SUEZ SA

Other publications

9 November 2023 - Press release "SUEZ successfully launches a 500 million euros green bond issuance"

2 October 2023 - Press release "SUEZ successfully priced an inaugural £600 million Green Bond issuance"

28 October 2022 - Press release "SUEZ has successfully completed a new €1.7bn Green Bond issuance"

16 May 2022 - Press release "SUEZ has successfully placed its inaugural €2.6bn Green Bond"

27 April 2022 - New SUEZ scope 2021 Combined financial statements

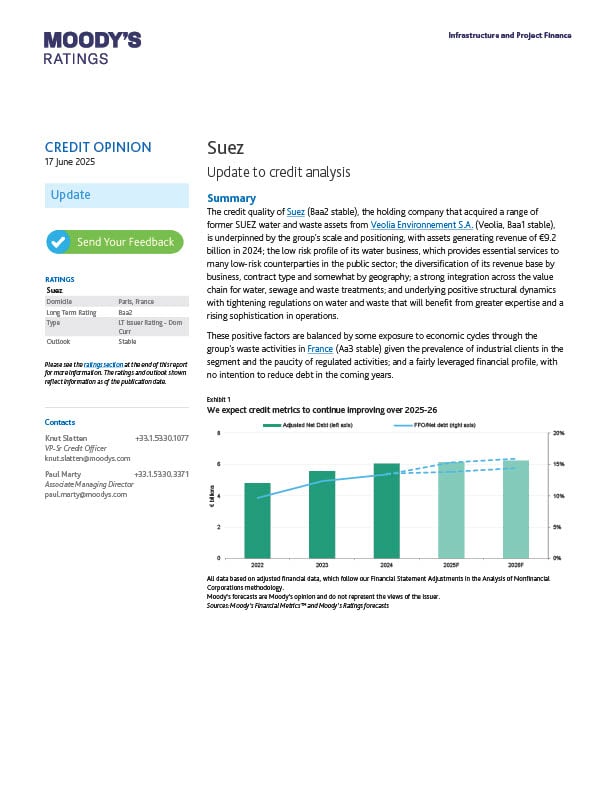

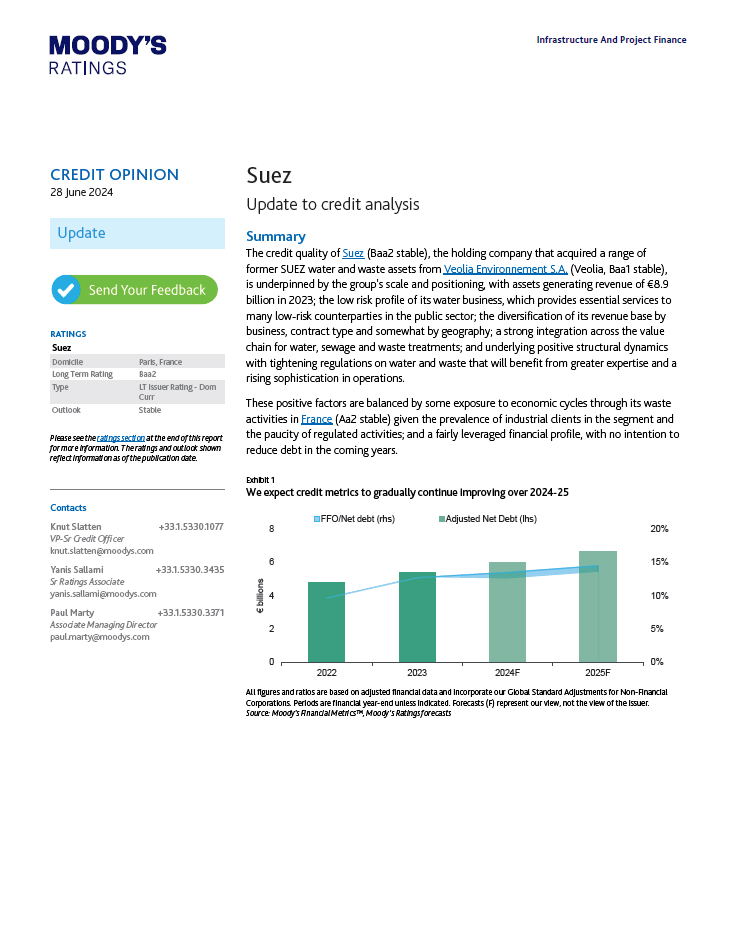

Moody's rating

| Long term | Baa2 Negative outlook |

| Short term | Prime-2 |

Green Financing Framework

Bonds

| Currency | Outstanding amount | Coupon | Settlement Date |

Maturity Date |

ISIN |

Final Terms |

|---|---|---|---|---|---|---|

| EUR | 750m | 1.875% |

May |

May 24th 2027 |

FR001400AFL5 | Open the document |

| EUR | 850m | 2.375% |

May 24th 2022 |

May 24th 2030 |

FR001400AFN1 | Open the document |

| EUR | 1,000m |

2.875% |

May |

May 24th 2034 |

FR001400AFO9 | Open the document |

| EUR | 800m |

4.625% |

November 3rd 2022 |

November 3rd 2028 |

FR001400DQ84 | Open the document |

| EUR | 900m |

5.000% |

November |

November 3rd 2032 |

FR001400DQ92 | Open the document |

| GBP | 600m | 6.625% | October 5th 2023 |

October 5th 2043 |

FR001400L461 | Open the document |

| EUR |

500m | 4.500% | November 13th 2023 | November 13th 2033 |

FR001400LZO4 |

Open the document |

| EUR | 250m |

4.500% | July 2nd 2025 |

November 13th 2033 |

FR0014010XD9 (to funge with original ISIN FR001400LZO4 after 40 days) |

Open the document |

| EUR | 175m | 5.000% | November 19th 2025 | November 3rd 2032 | FR0014014AM0 (to funge with original ISIN FR001400DQ92 after 40 days) |

Open the document |

Base prospectus

Base Prospectus dated 7 October 2024